salt tax cap repeal 2021

A rollback of the cap on the state and local tax SALT deduction is on ice after Sen. Expansion of SALT Cap Workaround SB 113 expands the SALT cap workaround by allowing the credit for taxes paid by the entity to offset the California tentative minimum tax of 7 percent of taxable income for tax years beginning on.

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

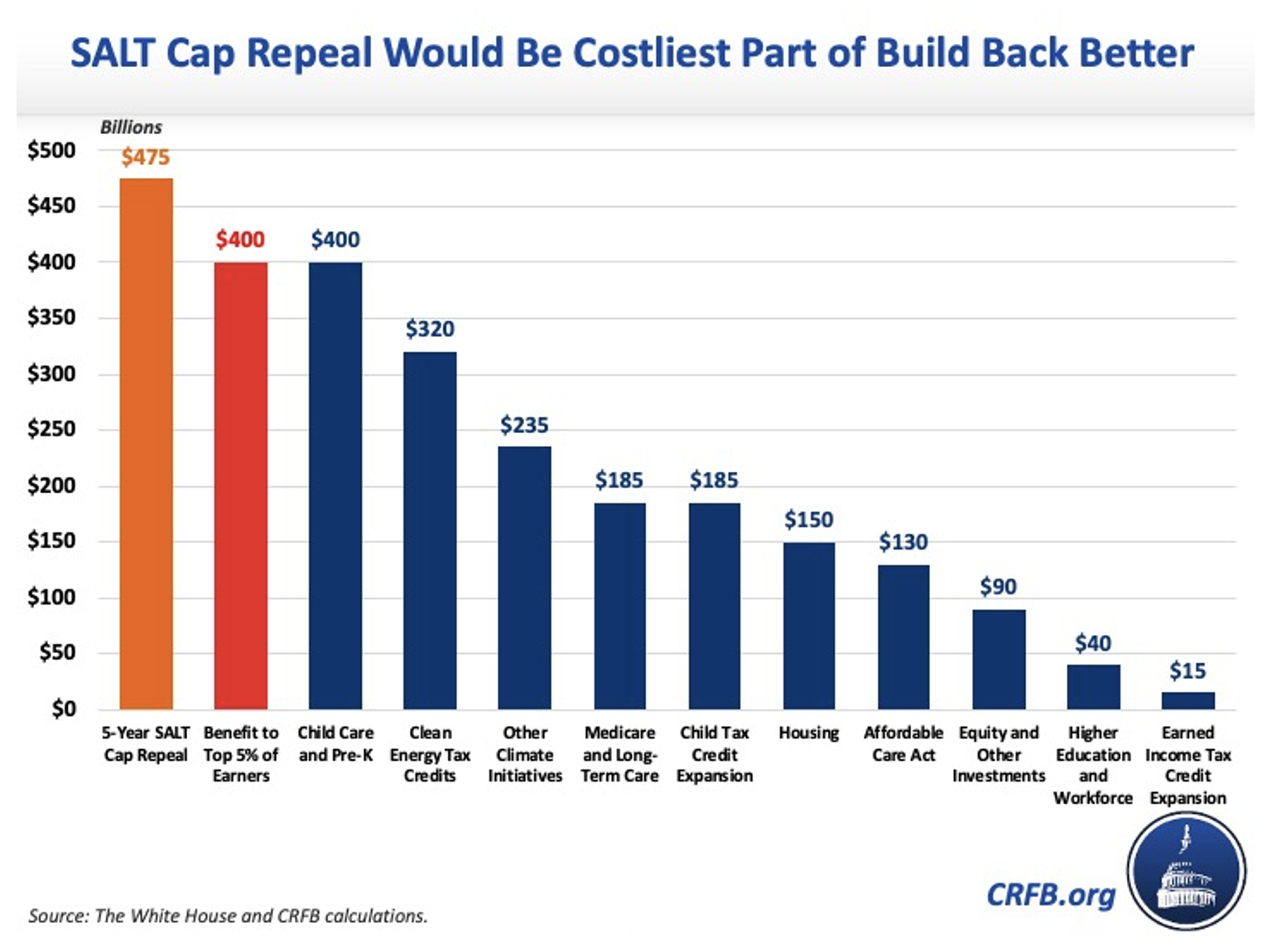

Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation.

. As President Bidens tax plans are considered in Congress the future of the 10000 cap for state and local tax deductions SALT is becoming an important part of the tax debate. That was bad news for top earners in blue states such as California and New York. Three House Democrats say they wont support any of President Joe Bidens tax hikes to fund his infrastructure proposal unless the plan includes a repeal of the 10000 cap on state and local.

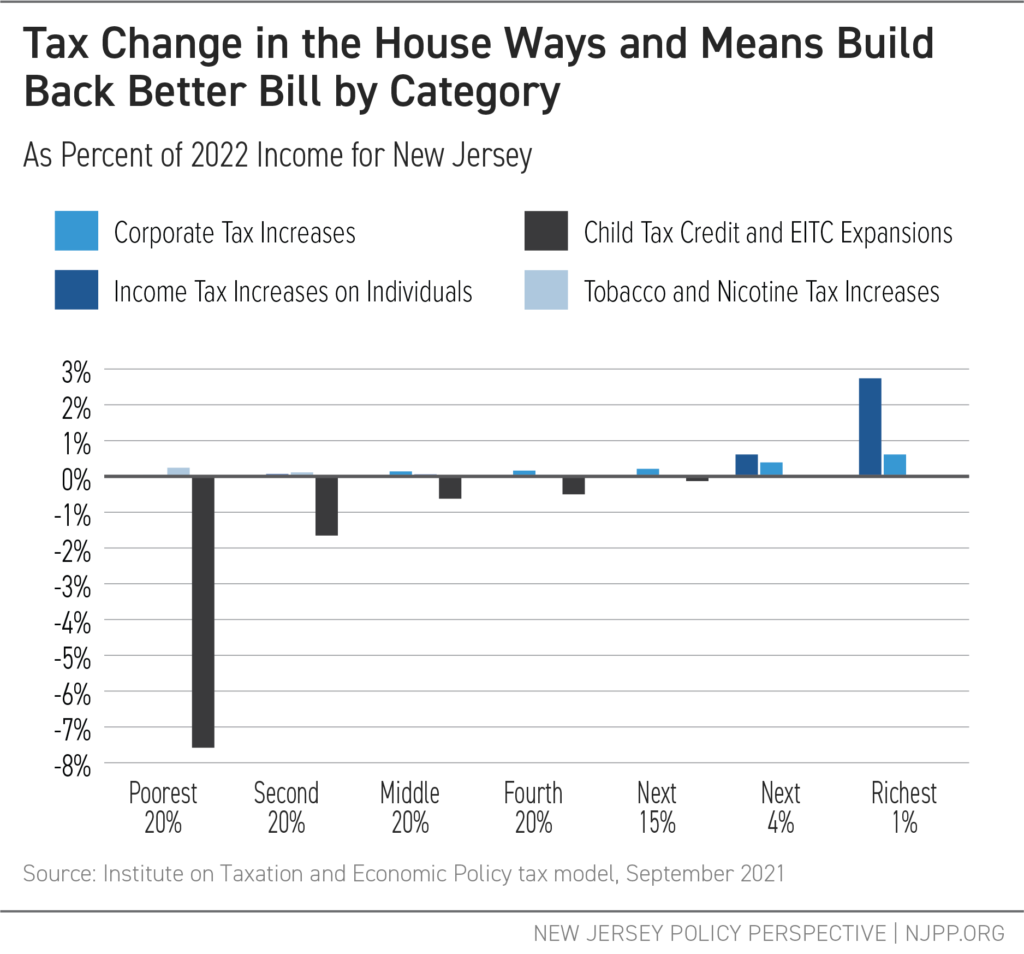

The deduction previously unlimited was capped at 10000 as part of the 2017 tax bill. A Democratic proposal aims. Middle-income households would get an average 2021 tax.

2021 203 PM UTC Updated on. Nov 19 2021. But the Tax Cuts and Jobs Act limited that deduction to 10000.

The cap on the SALT deduction started in 2018 because of the Tax Cuts and Jobs Act a tax reform passed in 2017. Over 50 percent of this reduction would accrue to taxpayers in just four. The SALT cap limited the federal income tax deduction for state and local taxes and the states most impacted were those with high local taxes.

It allows people to deduct payments like state income and local property taxes from their federal tax bills. A new bill seeks to repeal the 10000 cap on state and local tax deductions. Americans who rely on the state and local tax SALT deduction at tax time may be in luck.

Dec 2 2021. Various Democrats and some Republicans in. This would be in place of the House plan to lift the cap to 80000 through 2030 and reinstate it at 10000 for 2031.

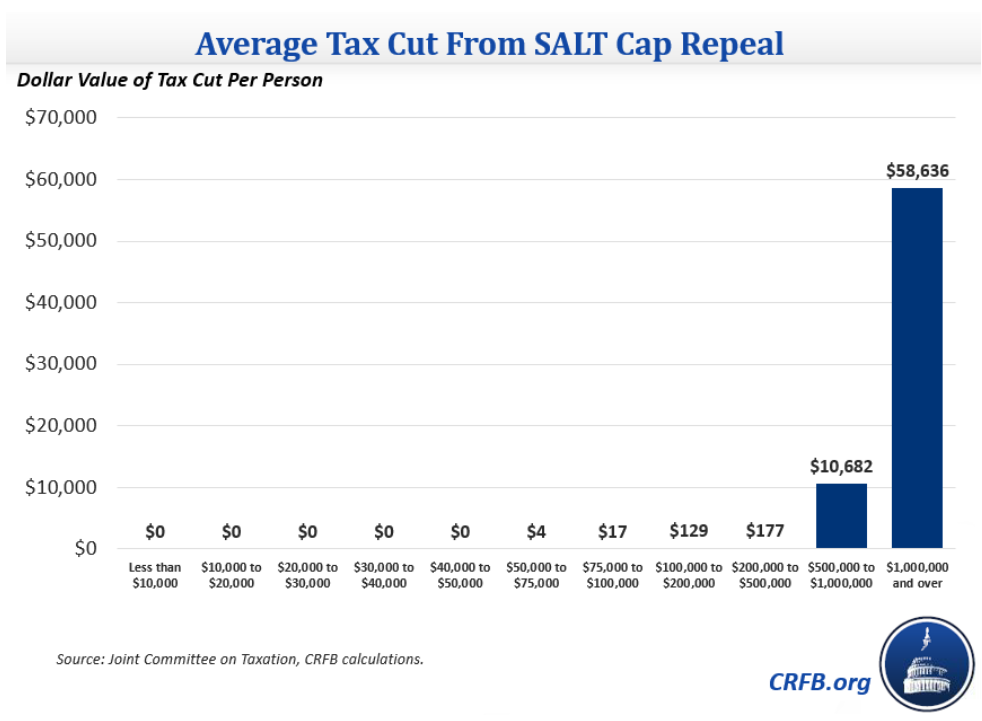

Those making between 370000 and 870000 would get an average tax cut of about 1500 in 2021 or 04 percent of after-tax income. Representative Josh Gottheimer said a repeal of the 10000 cap on state and local tax or SALT deductions could be offset by cracking down on tax cheats the first proposal from Democrats as a way to pay for revival of a valuable tax break. April 19 2021 629pm.

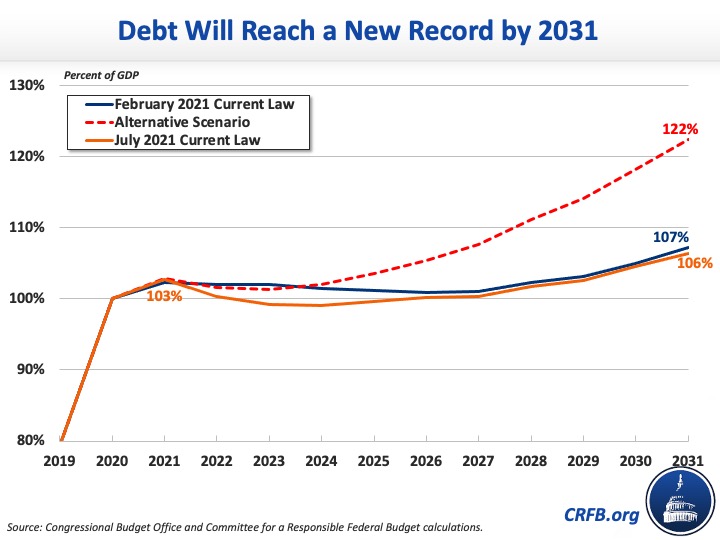

See what other deductions changed in 2018 How. Joe Manchin D-WVa raised broader objections to President Bidens social spending and climate package. Congress seems to be considering two ways to address the Tax Cut and Job Acts 10000 cap on the state and local tax SALT deduction.

The deduction was unlimited before 2018. 52 rows This cap remains unchanged for your 2021 taxes and it will remain the same in 2022 if Congress doesnt remove the cap in its spending bill. Andrew Cuomo says President Bidens infrastructure package should include repeal of the SALT cap.

For 2021 the standard deductions are 12550 for single filers or 25100 for married couples filing together meaning they wont itemize if write-offs including SALT medical expenses. The Tax Cuts and Jobs Act imposed a 10000 cap on the itemized deduction for state and local taxes from 2018 through 2025. The early repeal of the NOL suspension and business credit limits comes amid strong tax revenues and a 457 billion budget surplus.

As President Joe Biden and policymakers in Congress consider changes in tax policy over the coming year the fate of the 10000 state and local tax SALT deduction cap. Paying a state income tax of 10 percent or more. The 10000 limit would then return in 2031.

In this report 1 we. Here are must-know changes for the 2021 tax season. In the meantime.

Heres how Democrats plans affect Americans with big state and local tax bills. Certain members of the House and Senate want the SALT deduction cap removed which would benefit primarily higher earnersand result in a 380 billion reduction of federal revenue. How to pay 0 capital gains taxes with a six-figure income.

Several senators are apparently pursuing revenue neutral state and local tax SALT deduction cap relief meaning the cost of increasing the SALT deduction cap through 2025 would be fully paid for on paper by extending it past its current expiration date of 2026 through 2031. The New Jersey Democrat said Monday that increasing funding for the Internal Revenue Service to boost enforcement efforts. AFP via Getty Images.

House Democrats pass package with 80000 SALT cap till 2030. 54 rows January 25 2021. Repealing the SALT cap in 2021 would reduce federal income tax liability by approximately 91 billion or 72 percent.

In this case revenue neutrality is simply a budget. The current proposal agreed to in an amendment late last week would increase the cap from 10000 to 80000 through 2030. What SALT tax cap repeal could mean for Florida.

As alternatives to a full repeal of the cap lawmakers and experts have proposed a. According to press reports the Senate is considering repealing the 10000 cap on the state and local tax SALT deduction for those making 500000 per year or less. It was a last-minute tweak.

Various proposals are under discussion in Congress this week to repeal the SALT cap. One would allow unlimited state and local tax deductions for people earning up to 400000 with a limited phase. Will see the most noticeable effects from lifting the.

That figure dropped to 21 billion in 2020.

The Latest Salt Cap Fix Would Mostly Benefit High Income Households Do Little For Middle Income People

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Dems Hike Taxes On Middle Class To Pay For 475b Salt Tax Shelter For Rich Ways And Means Republicans

House Democrats Propose Increasing Salt Cap To 72 500 Through 2031

Build Back Better Legislation Makes The Tax Code Fairer But Only If Salt Cap Stays In Place New Jersey Policy Perspective

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Our Top 21 Fiscal Charts Of 2021 Committee For A Responsible Federal Budget

Chinese Stock Educational Technology Education Related Student Loans

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Crfb Org On Twitter Breaking Salt Cap Repeal Below 500k Still Costly And Regressive We Published A New Blog Focusing On A Rumored Salt Cap Relief Deal For Those Making 500k Per Year

Cannon S Canon The Height Of Hypocrisy Eliminating The Salt Cap Utah Taxpayers

By Backing A Huge Tax Giveaway To The Rich Democrats Are Giving The Gop A Perfect Midterm Gift

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

U S Lawmakers Pepper Congress With Pleas For Salt Tax Break Florida Phoenix

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Salt Deduction Relief May Be In Peril As Build Back Better Stalls

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less