what is fsa health care reddit

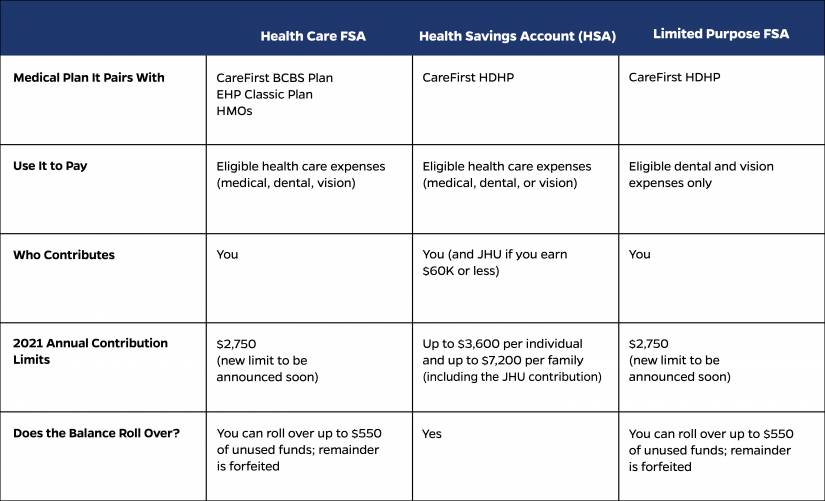

If youre enrolled in a qualified high-deductible health plan and have an HSA you can maximize your savings by pairing your HSA with a Limited Purpose Flexible Spending Account FSA. When you open a health FSA your employer puts an agreed.

Lower Your Taxes With Spending Accounts Hub

This includes things like child care from in home babysitting to day care and preschool as well as adult care.

. More Health Reimbursement Arrangement HRA. The problems is its a pain in the ass the online enrollment is a pain in the ass have to fax all the receipts with a special form I have to fill. Impact of the CARES Act on FSAs and HSAs The Coronavirus Aid Relief and Economic Security CARES Act created important provisions for health savings accounts HSAs and flexible spending accounts FSAs for 2020 and 2021.

And 3 Dependent Care FSA DCFSA. An FSA is a great tax savings tool to effectively pay for qualified out-of-pocket healthcare expenses. Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars.

My employer has a program where we can get money taken out pre-tax to put towards medical or dependent care costs FSA. Take for example a worker who earns 70000 and files a. Lets look at some of the pros and cons for both employers and employees as explained in the new International Foundation Flexible Spending Accounts.

An FSA does offer tax savings and budgeting for medical expenses so if you dont qualify for an HSA an FSA is also a good option. 2500 for married people filing separately. Learn the pros and cons of health share plans.

With both FSAs and HSAs you can pay for things like co-pays medical bills and vision expenses. During open enrollment or whenever you experience a qualifying life event like welcoming a child or getting married or divorced. A Flexible Spending Account FSA has benefits you want to pay attention to.

A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs. Health FSA of article Flexible spending account. Keep in mind that FSAs have a maximum rollover of 500 so you have to spend down to that level in order to not lose money.

An FSA or Flexible Spending Account is a tax-advantaged financial account that can be set up through an employers cafeteria plan of benefits. Generally FSAs can be used to reimburse costs for dependent care adoption or medical care but you cant do all three with one FSA. An FSA is a tool that may help employees manage their health care budget.

You decide how much to put in an FSA up to a limit set by your employer. A dependent care FSA is specifically intended to pay for dependent care expenses while a healthcare FSA is. These accounts use pre-tax money from your paycheck that you can use to pay for medical dental or vision care costs.

5000 for individuals and married couples filing jointly. Its a smart simple way to save money while keeping you and your family healthy and protected. If you are in the 25 tax bracket that can save you up to 670 per year in taxes.

Always keep the latest FSA contribution limits in mind in 2022 you can contribute up to 2850. This means youll save an amount equal to the taxes you would have paid on the money you set aside. FSAs and HSAs are pre-tax accounts you can use to pay for healthcare related expenses.

Keep in mind you will still have that 2700 to spend on medical expenses and equipment. You also loose it if you change jobs. A Flexible Spending Account FSA is an employee benefit that allows you to set aside money on a pre-tax basis for certain health care and dependent care expenses.

If you make an FSA election for the 2021 plan year. Employer contributes nothing to this it is all my money just pre-tax. An FSA is not a savings account.

However it cant exceed the IRS limit 2750 in 2021. What Is a Flexible Spending Account FSA. FSAs can be used for other things too that are qualified expenses things like glasses and contacts can count too.

I was at CVS about a month ago and I carried some vitamins up to the pharmacy desk. Tax-free contributions tax-free growth and tax-free distributions. 5 hours agoFinancial advisors tout the triple tax advantage that an HSA offers.

To qualify for an HSA you must have a high deductible health plan. A Limited Purpose FSA is a Flexible Spending Account FSA that is compatible with a Health Savings Account HSA. Heres how a health and medical expense FSA works.

Another type of account is the Dependent Care FSA. Theres no reason not to save on taxes when you have the opportunity to. 2 Limited Expense Health Care FSA LEX HCFSA.

Employers set the maximum amount that you can contribute. The Healthcare FSA is the one this post is covering. Allowed expenses include insurance copayments and deductibles qualified prescription drugs insulin and medical devices.

For example if you earn 45000 per year and allocate 2500 to your FSA for health care expenses your estimated tax savings from your FSA is 812. Is offering an FSA plan worthwhile. A flexible spending account FSA is an individual account that can reimburse an employee for qualified medical expenses and work-related dependent care expenses.

1 Health Care FSA HCFSA. These are pre-tax dollars allowing you major tax savings. A major benefit of an FSA is that you can contribute up to 2700 in 2020 per year in tax-free funds to your FSA.

Employers may make contributions to your FSA but. The most common type of FSA is used to pay for medical and dental expenses not paid for by insurance usually deductibles copayments and coinsurance for the employees health plan. There are three types of FSA accounts.

Currently my companys health care provider provides a debit card to use for medical expenses. This pre-tax benefit account lets you take advantage of the savings. Health FSA and limited-purpose FSA.

You dont pay taxes on this money. If you have a Health FSA also sometimes called a Medical FSA you can use it to pay for eligible out-of-pocket medical expenses with pre-tax dollars. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere.

But heres the dealin order to use the calculator to accurately estimate your health care. A flexible spending account FSA is a type of savings account usually for healthcare expenses that sets aside funds for later use. When you can modify your contribution rate.

This plan is used to help pay for dependent care expenses. Tax-advantaged health savings accounts like HSAs and FSAs are good ideas if you know you will be having medical expenses. These accounts use pre-tax money from your paycheck that you can use to pay for medical dental or vision care costs.

The system would allow me to use my FSA debit card for the prescriptions but not for the vitamins because I dont actually have a prescription for them. Have to agree here with OPs medical costs being so low right now the cost savings in an FSA would be minimal and there is a better chance they would loose it before they spent it.

Raspberry Pi Tutorial Features Specifications And Functionalities Raspberry Pi Python Projects Reddit Paperback Walmart Com

Diamond Hands Wsb Wallstreetbets Mascot Kid Logo Reddit To The Moon Sticker Gme Walmart Com

Health Care Flexible Spending Accounts Don T Lose Your Fsa Money My Money Blog

Senior It Systems Engineer Atlassian Reddit Built In

Senior It Systems Engineer Atlassian Reddit Built In

Flexible Spending Accounts For Health Care Dependent Care Parking City And County Of Denver

New Job Mid Year Worth It To Contribute To Fsa R Personalfinance

Can I Pay For Mental Health Care Using My Fsa Or Hsa

Into The Breach Game Switch Secret Squad Tips Reddit Mac Wiki Download Guide Unofficial Paperback Walmart Com

New Possible Ms Option Ymmv R Churning

Psa Use Your Fsa Or Hsa While You Re Employed To Buy Pa Schools Supplies R Prephysicianassistant

Accidentally Enrolled In Hsa While Covered By Fsa What Now R Personalfinance

Picking Specialist Principles Uk R Actuary

Question About Pip Vs Medical Payments Actual Scenario Below R Insurance

Neutrogena Hydro Boost Spf 50 Hyaluronic Acid Moisturizer 1 7 Oz Cvs Pharmacy

Can I Pay For Mental Health Care Using My Fsa Or Hsa

![]()

Why Or Why Not Do You Support The War On Drugs R Askreddit

Fsa Mistakes To Avoid Spouse Dependent Rules American Fidelity